Rideshare

Car insurance for rideshare drivers

Fast, flexible and affordable. Get cover when driving on platforms like Bolt, DiDi, OLA, Shebah and UBER

Coming soon.

Why do you need RideCover?

Fast

- Immediate cover available

- Buy and manage your policy online

Flexible

- Cover for part-time and full-time drivers

- Monthly payments at no additional cost

Affordable

- No hidden fees

- No cancellation fees

Avoid time-consuming and expensive options

We know that adding rideshare insurance to your existing insurance can be time-consuming and inefficient. That is why we have created RideCover.

Just add RideCover

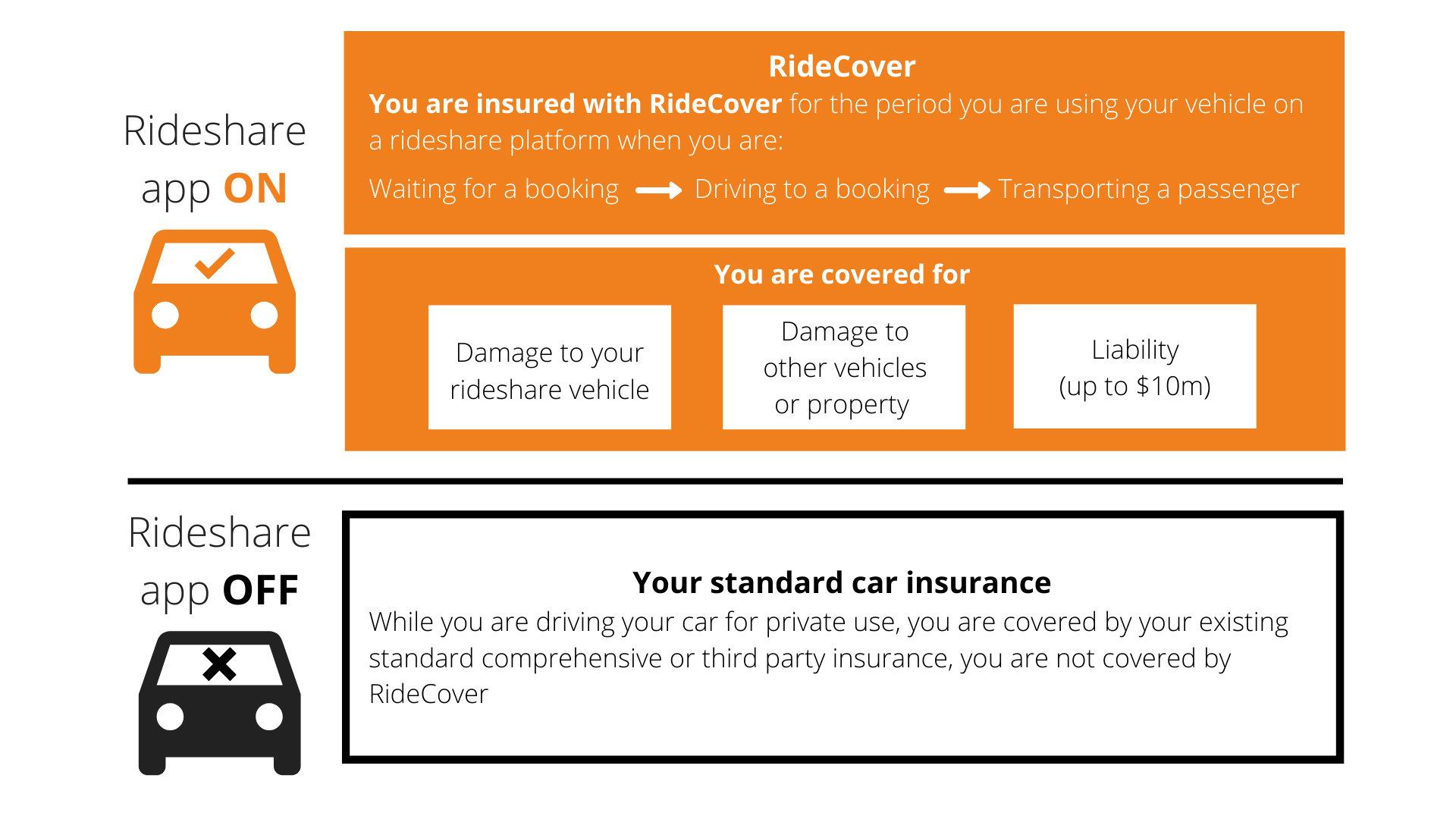

No need to change your existing car insurance policy, just add RideCover to your existing standard private use comprehensive or third-party car insurance and you're covered when using your car for rideshare driving. For more information, please read our PDS.

What is included in RideCover?

What is covered?**

-

Loss or damage to your vehicle up to the value of $50,000. caused by:

- Collision or crash

- Explosion and fire

- Malicious acts

- Liability up to $10m for claims made against you for loss or damage to someone else’s property

- Additional benefits – towing, vehicle pick up and return

What is not covered?**

Risks not connected to rideshare driving, including:

- Damage from natural perils such as storms, bushfire, flood etc

- Theft

- Vandalism

- Anything caused or sustained by you or your vehicle during private use of your vehicle

** For a full list of covered events, exclusions, and limitations please read the PDS.

Services

What services do we cover?

- We cover rideshare services for drivers transporting human passengers

What services don’t we cover?

- We do not cover couriers or food delivery services

Vehicles

What vehicles do we cover?

- Cars weighting 4,500kg or less

- Cars constructed to seat up to 12 adult passengers

What vehicles don’t we covered?

- Motorcycles

- Mopeds

- Scooters

- E-scooters

- Trikes

- Heavy vehicles (including buses)

- Taxis

When does RideCover apply?

Things to know

RideCover does not replace the need for comprehensive and/or third party insurance for your vehicle. It also only covers loss or damage caused by certain listed events and does not cover your vehicle for loss or damage caused by natural perils (storms, bushfire, flood etc).

RideCover does not cover any driver that is aged less than 21 years or has not held their licence for two or more years.

If we accept a claim for loss or damage to your vehicle we will:

- repair the vehicle or pay the cost to repair your vehicle; or

- pay you the lower of the market value of the vehicle or $50,000.

If we accept a claim under the liability cover, we will cover the cost of your legal liability for loss or damage to someone else’s property up to $10,000,000 for any one incident.

FAQs

You can be confident in knowing we're proudly backed by Insurance Australia Group.

IAG is the name behind some of the most trusted and respected insurance brands in the regions in which it operates. Its businesses have helped people recover from natural disasters, accidents and loss since 1851.

IAG's businesses underwrite over $11billion of premium per annum, selling insurance under many leading brands including NRMA Insurance, CGU, SGIO, SGIC, Swann Insurance and WFI (Australia); and NZI, State, AMI and Lumley Insurance (New Zealand).

Standard & Poor's has assigned a 'Very Strong' Insurer Financial Strength Rating of 'AA-' to the Group's core operating subsidiaries.

Rideshare

RideshareShareCover is issued by Insurance Australia Limited ABN 11 000 016 722 AFS Licence No. 227681 trading as ShareCover Enterprises. When making decisions about a product, always read the Product Disclosure Statement (PDS). For home policies, please also read our Key Fact Sheets (KFS) for buildings and contents which set out some of the events/risks covered and not covered by our home policies and other information you should consider. These sheets do not provide a complete statement of the cover offered, exclusions, conditions and limits that apply under the policies. You should carefully read the Product Disclosure Statement (PDS) and all policy documentation for more details.

To help you make an informed choice on insurance visit the Australian Government website: www.moneysmart.gov.au

ShareCover Enterprises is owned by Insurance Australia Limited and is not related to either Airbnb, Bolt, Booking.com, DiDi, OLA, Shebah, Spacer, Stayz and Uber. References to these platforms on this website do not constitute an endorsement by these platforms of ShareCover nor an endorsement of these platforms by ShareCover; nor IAG being partnered with these platforms.